Homeownership isn’t just part of the American dream—it is the dream. A house represents stability, security, and a foundation for the future. But right now, for millions of families—especially fathers trying to give their kids a stable home—that dream feels further away than ever. Simply put, the housing market has been frozen for years, and it’s not showing any signs of warming up any time soon.

For many newly minted dads, this housing crisis is more than just frustrating—it’s shaping the way we think about the future. We’re at a stage in life where we’re supposed to be moving forward, establishing a home for our kids, and building a future for our families. But instead, we’re stuck in a cycle of rising rents, sky-high home prices, and an economy that feels like it’s working against us. We’ve done what we were told—gotten good jobs, worked hard, saved up—and yet the finish line keeps moving further away.

Why It Matters: Stability & Then Some

When fathers (and parents in general, but this is a fatherhood Substack—sue me) are looking at buying a home, it isn’t just about ownership & investment. It’s about providing stability for our kids.

A home means security. It means not worrying about rising rent, surprise evictions, or having to uproot your family every time a lease ends. It means kids can stay in the same school district, build lasting friendships, and feel safe knowing they won’t have to pack up and move every couple of years.

Stability is also financial. Renting often costs as much as—or more than—a mortgage, but renters don’t build equity. Every rent check is money that’s gone forever, while mortgage payments build toward ownership. Over time, homeownership has been one of the most reliable ways for families to create financial security. Without it, many dads feel like they’re working hard just to stay in place, unable to get ahead.

Finally, for many fathers, homeownership is about legacy. It’s about having something to pass down to our kids. Owning a home means creating a foundation not just for ourselves, but for the next generation. It’s knowing that, even in tough times, there’s something tangible to leave behind. It’s knowing that your hard work will provide stability not just for your children but for their children as well.

Owning a home isn’t just about having a place to sleep at night. It’s about building a future. And for many American families, right now, that future feels further away than ever.

So how did we get here? And what, if anything, can be done to fix it?

The Housing Market Sucks - Here's Why

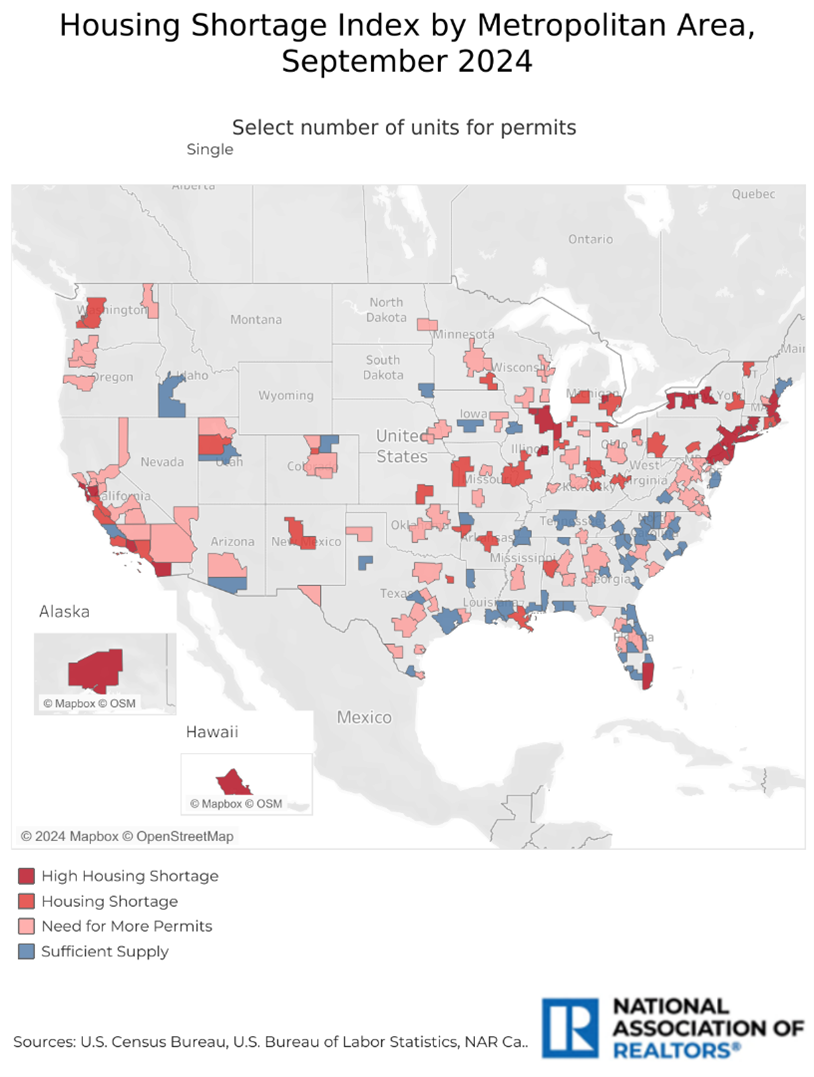

One of the biggest reasons home prices remain high is that there simply aren’t enough houses to meet demand. For years, new home construction has lagged behind population growth, making it harder for buyers to find affordable options. Strict zoning laws, which favor single-family homes over townhouses or multi-family buildings, have prevented new construction in many cities. Builders are also facing higher costs, with labor shortages and expensive materials slowing down production.

I had an electoral college joke here, but my wife advised against it.

You win this round, National Association of Realtors.

Interest rates are another major obstacle. For over a decade, mortgage rates hovered at historic lows, often below 3%. That changed quickly. Today, rates are sitting at 6-7%, making monthly payments significantly more expensive. A family that could afford a $400,000 home at 3% interest now may find that same home unaffordable at 7%, even if their income has grown. Higher rates are pricing many would-be buyers out of the market entirely.

These interest rates have also contributed to what’s been called "the lock-in effect." Millions of homeowners refinanced during the pandemic when rates were low, securing mortgage payments that are now much cheaper than anything available today. This has created a housing freeze. Homeowners who might otherwise sell and move to a larger home, downsize, or relocate are staying put because they don’t want to trade their low mortgage for a new one with much higher monthly payments. Fewer people selling means fewer homes on the market, which keeps prices high and limits options for first-time buyers.

Put all of this together, and it’s easy to see why so many families feel stuck. It’s not just that homes are expensive—it’s that everything about the current system is making it harder for new buyers to get in.

There’s No Silver Bullet—But These Could Help

Just as there’s no one main reason the housing market is stuck, there isn’t a one-size-fits-all solution.

Before we start, let’s clear the air: interest rates are set by The Federal Reserve, which operates independently (for now at least). Over the past few years, we’ve all seen how the Fed uses interest rates to fight inflation, and with inflationary pressures sticking around, rates are likely to stay where they are for the foreseeable future. That means we’ll be here a while if we just wait for mortgage rates to drop—if the housing market is going to open up any time soon, it’s going to take policy changes.

One approach would be reforming zoning laws to allow for more housing options. My home city of Austin, Texas, has been revising zoning codes to make it easier to build townhomes, duplexes, and apartments in areas that were previously limited by lot size. Now, Austin is one of three major housing markets that has enough supply to meet demand. Expanding these efforts nationwide could help increase supply and offer families more affordable options. However, local resistance to development remains a challenge in many areas, meaning any zoning changes would require balancing community concerns with the urgent need for more housing.

Local and state governments might also consider exploring property tax relief programs to help first-time buyers. In high-tax states, even homeowners who can afford a mortgage may struggle with steep annual tax bills, making long-term affordability a challenge. Some states have experimented with offering property tax exemptions or credits for first-time buyers as a way to ease this burden. Expanding these programs could help, but they would need to be structured in a way that doesn’t unintentionally drive up home prices further or tank government budgets.

At the federal level, there’s also the option of expanding access to tax-advantaged savings programs to help families set aside money for homeownership. You might know some of these already – health care spending HSAs, education savings 529 plans, and Roth IRAs are all examples. One potential approach would be creating tax-free savings accounts to be used for housing expenses, making it easier for renters to transition into homeownership. Similarly, expanding tax credits for down payments and closing costs could provide much-needed assistance for families who are struggling to save enough to buy a home.

Another possible solution is reducing tariffs on building materials like lumber and steel. These tariffs drive up construction costs, making new homes more expensive than they might otherwise be. Lowering or eliminating these tariffs could ease costs for builders and, in turn, make home prices more affordable for buyers. However, given President Trump’s recent moves to enact more tariffs (including on lumber), this isn’t likely to happen any time soon.

These solutions range across the political spectrum, and none of them alone will fix the housing crisis overnight; however, together, they could begin to ease the barriers that are keeping families locked out of homeownership. The key is finding a combination of policies that balance affordability, supply, and long-term economic sustainability.

The Bottom Line

The current housing crisis isn’t just a problem for the economy—it’s a problem for families. Fathers trying to provide stability for their kids are finding themselves locked out of the market, with few affordable options and no clear path forward.

The good news is that housing issues aren’t impossible to fix. Cities that have updated zoning laws are already seeing progress. Cutting down on unnecessary costs and offering smart financial incentives could help more families buy homes. But until meaningful changes happen, homeownership will remain out of reach for far too many families.

For those of us who are trying to build something stable for our families, the urgency of fixing this problem is clear. A home isn’t just a piece of property—it’s the foundation of a family’s future.

Lock in effect is so real. Another thought in the same vein that myself and at least 2 close friends are in: Our homes have increased in value 25% or more. However, if we sold with that equity, we couldn't afford the same house again. Ex. Bought for 200, 3 years later worth 250, can't buy same house for less than 300. Stuck.